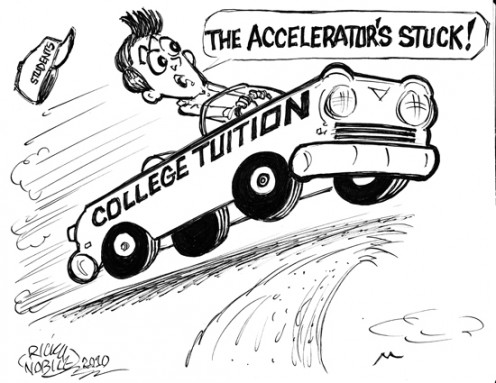

Best available investments plan option to save for child's and grandchildren's college education

In this article I like to share with you some of the most popular savings accounts for kids' education available to parents. Please keep in mind that the college saving account plans, tax laws and the income limits are constantly changing in order for you to qualify for part or all of the tax-free benefits offered by some of these educational savings accounts/investment options. Therefore, this is an area where you will definitely need to stay abreast of all the latest tax changes. I have also given links to some websites where you can get the latest information on the various college saving plans and college saving accounts.

Some of the college savings account / investment options available

- Personal Savings

- Custodial accounts (UGMA & UTMA)

- US Saving Bonds

- Coverdell Educational Savings Accounts (Educational IRAs)

- 529 Qualified Tuition Plans (QTP), including education savings accounts and prepaid tuition plans

- Some additional college education saving options

1. Personal Savings in Parent's name

Advantage

| Disadvantage

|

|---|---|

Most flexible of all saving options available to the parents

| Doesn't offer tax-free growth (when parents sell the investment to fund the education they have to pay long term capital gains tax)

|

Investment remains the property of the parents and under their complete control

| |

No income limits to worry about

| |

Funds can be invested in any manner (stocks, bonds, Mutual Funds..) that the parents choose

| |

There are no conditions on when, how or even if the money has to be spent, or who it has to be spent on

| |

Money does't have to be earmarked for any particular child

| |

Money can be used for other purposes too ( eg retirement)

|

Please take part in the Poll

Do you like to save for your child's college education ?

2. Custodial Accounts:

Custodial accounts created under Uniform Transfer to Minors Act (UTMA) or Uniform Gifts to Minors (UGMA) are one way that parents can earmark funds for their children's education. It has lots of tax benefits. Smaller amounts of earnings escape taxation entirely because the child doesn't have an income to owe taxes. Once the earnings exceed the child's unearned income limit, all excess earnings are subject to the kiddie tax, which means those excess earnings will be taxed at the parent's tax rate. When the child reaches 14, earnings are again taxed at the child's own rate, which will be lower than parent's.

This education saving account have several potential problems. If your son, Jack wants to buy a motorcycle using the college education savings, he can do so, and you can't do a thing about it. Child will have complete control over the account and can use it in the way he wants or spend it on some other things that he or she considers to be important.

Another disadvantage of this account is that, under the current law (2010), custodial accounts are considered the asset of the child. When he/she applies for financial aid, government formula expects up to 35% of child's account to be used for college fees. This means he will get less financial aid. In contrast, if the assets are kept in parent's name, the formula expects to take only 5.6% of assets each year.

Advantages

| Disadvantages

|

|---|---|

Can earmark for your child. Gifts of cash on birthdays and other occassions can be put to this account

| Child gains complete control over the money and can use in the way he wants.

|

Lots of tax benifits (tax calculated based on child's income)

| Considered to be the asset of the child. Therefore, lesser financial aid from government.

|

3. US saving bonds (both EE and I bonds)

If titled correctly, Saving Bonds qualify for the tax-free educational benefits. Bonds must be titled in one or both of the parent's name. It cannot be titled in child's name, but child can be listed in the bond as the beneficiary.

Some of the other requirements in order to obtain tax-free benefits

- You must be 24 years or older when you purchased the bonds

- Must meet the income requirements that are in effect at the time you use the bonds for educational purposes.

- If married you must file a joint return

- You must use the entire amount (interest and principal) to pay for qualifying educational expences for you, your spouse, or your dependants in the year that you redeem the bonds.

If your child get a scholarship, you could use the money for some other purposes. They will be continue to grow tax-deferred, for up to 30 years. It will act as an emergency fund and could contribute to your retirement asset and you can also benefit from the growing interest rates on savings.

US saving bonds

Advantages

| Disadvantages

|

|---|---|

Tax-free benefits for 30 years

| If incorrectly titled, will not have tax-free benifits

|

Could be used for non-educational purposes too

| Need to use the entire amount for educational purpose (to enjoy tax-free benefits)

|

4. Coverdell Education Savings Account (ESA)

ESA was formerly known us Educational IRA. The current contribution limit for ESA is $2000 per student. The growth in the account is tax free as long as the proceeds are used for any qualifying educational expences.

The definition of qualifying educational expences is much broader in ESA. It can be used to pay for the following

- Tuition fees for elementary, secondary, private, public and religious schools

- Books and supplies

- Room and board

- Computers

- Transportation

- Tutoring

- Contributions to a 529 Qualified Tuition Program (QTP)

Anyone who meets the current income requirements listed in IRS Publication 970 can open a Coverdell ESA and make contributions on behalf of a child's saving for college education.

ESA

Advantages

| Disadvantages

|

|---|---|

Growth in the account is Tax-free

| Contribution limit is only $2000

|

Broad definition for 'qualified educational expences'

| Contibutions cannot be made once the child turns 18

|

Funds must be used by the time the beneficiary turns 30

|

5. 529 Qualified Tuition Plans (QTP):

There are two types of QTPs; 529 college savings program and 529 prepaid tuition plans. Every state has its own 529 college savings plans and each comes with its own set of rules. The 529 college saving plan you decide to invest in doesn't have to be run by the state where you reside (most don't), or even where you expect your child to go to college. Therefore you are free to shop around for the best 529 educational savings account.

Second type of 529 prepaid tuition plan is a prepaid tuition plan that can be offered by a state or an educational institution. If your state offers a 529 prepaid tuition plan,you can prepay (in a lump sum or in instalments) some or all of the tuition for your child's future education at a state university at today's prices. Hence, the younger the child is, the lesser you have to pay. After you have prepaid your child's tuition at a state university, should your child decide to go to a private school, or attend college in another state, you will be allowed to use some or all of the value of your 529 college savings accounts to pay for your child's education at the other school.

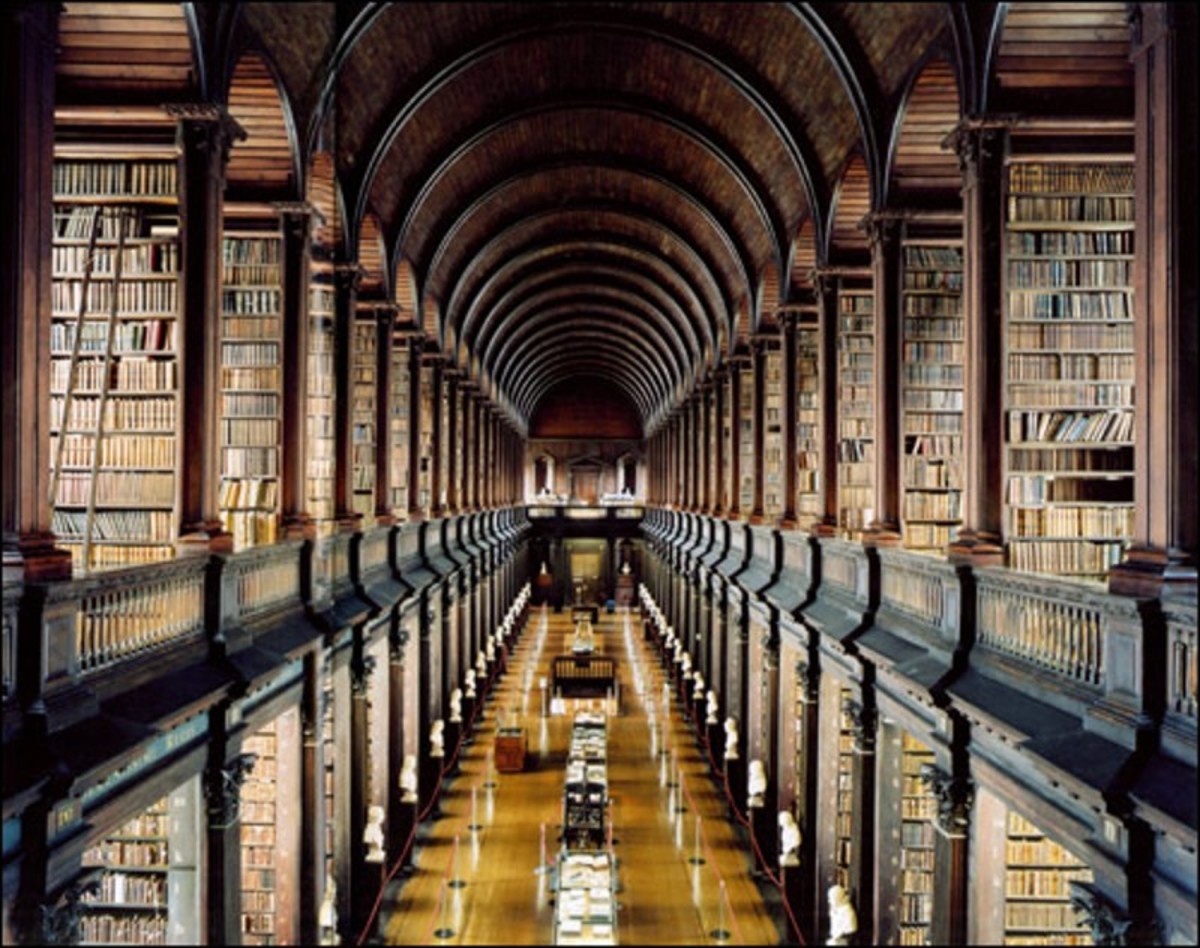

Planning higher education

QTP educational saving plan

Advantages

| Disadvantages

|

|---|---|

Allows substantial contributions - $55,000 (by an individual) and $110,000 (by a couple)

| Doesn't necessarily guarantee that it will cover all of your child's future college expenses, as prepaid plans do

|

Grandparents can contribute for their grandchildren's education and reduce the size of their taxes while befitting grandchildren (in some states contributions from all sources are allowed to be made until the total balance in the account reaches as high as $300,000 per individual)

| Investment choices in these plans are age based and becomes more conservative as the child gets closer to college age

|

Earnings in the 529 college savings account grow tax deferred

| Due to expire in 2011, unless the congress extends this favourable tax treatment or make it permanent

|

Withdrawals for qualifying educational expenses are currently tax free

| |

No income limits for those contributing to 529 plans

| |

Unlike UGMA or UTMA Custodial accounts, you retain complete control of the assets

| |

You can select the college saving plan from any state (doesn't depend on where you reside)

|

College saving Plans

- Savingforcollege.com - The internet guide to funding college and Section 529 college savings plans.

Save for future college costs by using qualified tuition plans (529 plans or 529 programs). 529 plans are state sponsored investment programs that are given special tax status.

6. Some other options available

- Employer paid tuition plans

- Scholarships

- Loans

- Federal grants

- Schoolwork programs

Attending a local community college for the first two years might be a lower-cost option. Many of these community colleges work hand in hand with local four-year colleges, and successful community-college graduates might be guaranteed admission into their four-year program.